Fixed Rate - Example 4 |

|

|

|

|

||

|

Fixed Rate - Example 4 |

|

|

|

|

|

Fixed Rate - Example 4

|

|

||

Fixed Rate - EXAMPLE 4 |

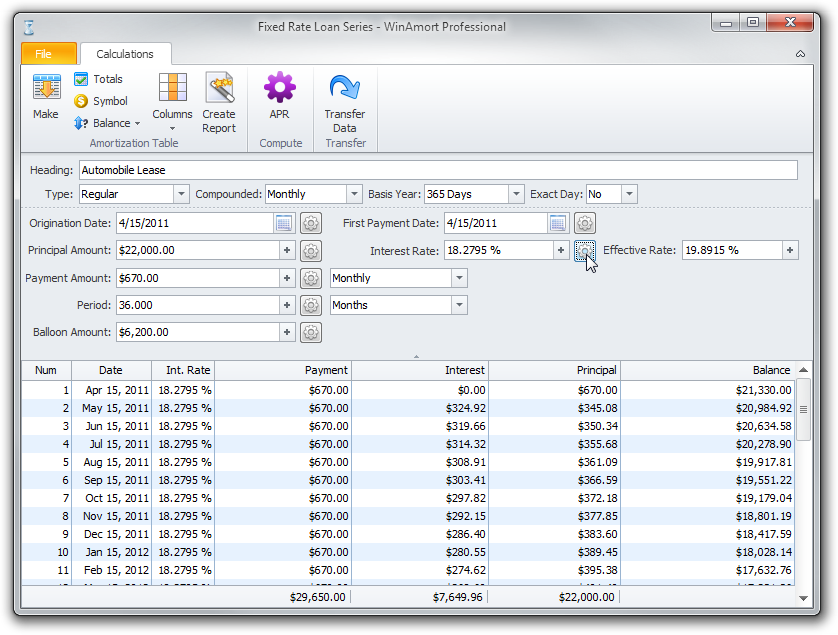

Your client would like to lease an automobile that costs $26,000. He can make a $4,000 down payment and enter into a contract where he would be making payments of $670.00 per month for 36 months. At the end of this term, the car can be purchased by the client for $6,200.00. On the other hand, the client could borrow the funds from the bank to purchase the car. The interest rate for the car loan would be 7.5%. What is the interest rate implicit in the lease? The date of the lease and first payment are April 15, 2011. |

![]() Solve The Interest Rate being charged in the lease.

Solve The Interest Rate being charged in the lease.

Enter in all of the relevant information given to you in the example. The first

Enter in all of the relevant information given to you in the example. The first

payment date can be the same as the origination date (leases can be paid in

advance, unlike loans which must be paid at the end of the month).

Fill out your form to resemble the one illustrated below.

Press

|

The Interest Rate implicit in the lease is 18.2795%. |

If you examine the question closely, you will see that you just used the compute

any field capability of WinAmort Pro to solve two very complex problems.

Usually it is virtually impossible to compute the Implicit Interest Rate in any lease.

However, once you understand that a lease is just another name for a different

type of loan you can use the information provided for in most leasing contracts,

to compute any unknown information.

Remember that in the second lease question it was straightforward problem to

determine what the interest rate was being charged. However, normally in

order to determine whether it is more beneficial to Buy or Borrow the funds to

acquire an asset, or to lease it you would require a more in-depth calculation.

This is possible using this Fixed Rate form along with the Future Value and

Present Value forms. For a complete lease or buy calculation, see the dedicated

Lease Chapter.

Before we continue with more examples and further explanations of the software’s

capabilities, we will explain the Basis Year field and why you may need to change

the default setting.

The Basis Year option, will allow you to set the length of year. To change the

year length:

![]() Down Arrow button beside the Basis Year field.

Down Arrow button beside the Basis Year field.

A list of different days in the year will appear.

Select the number of days that you want to set the year length using the mouse.

The year length is used to establish the daily rate of interest for odd days.

If a $100,000 loan at 12% interest is taken out on 11/05/1997, and the payments

are to start on 12/15/1997, there would be 10 odd days from the 5th of

November to 15th of December. The interest for the odd days would be as follows:

For 360 day Year: 10 * (.12/360) * $100000 = $333.33

For 364 day Year: 10 * (.12/364) * $100000 = $329.67

For 365 day Year: 10 * (.12/365) * $100000 = $328.77

If the dates were 11/05/1997 and 11/15/1997 for loan and payment dates respectively,

the odd days interest would still be the same as above because there are 10 odd days.

In most situations, the Basis Year setting will not be critical. But, when dealing

with calculations that involve odds days, or when the compounding frequency is

set to Daily, the Basis Year setting becomes very significant.