Present Value Example 1ab |

|

|

|

|

||

|

Present Value Example 1ab |

|

|

|

|

|

Present Value Example 1ab

|

|

||

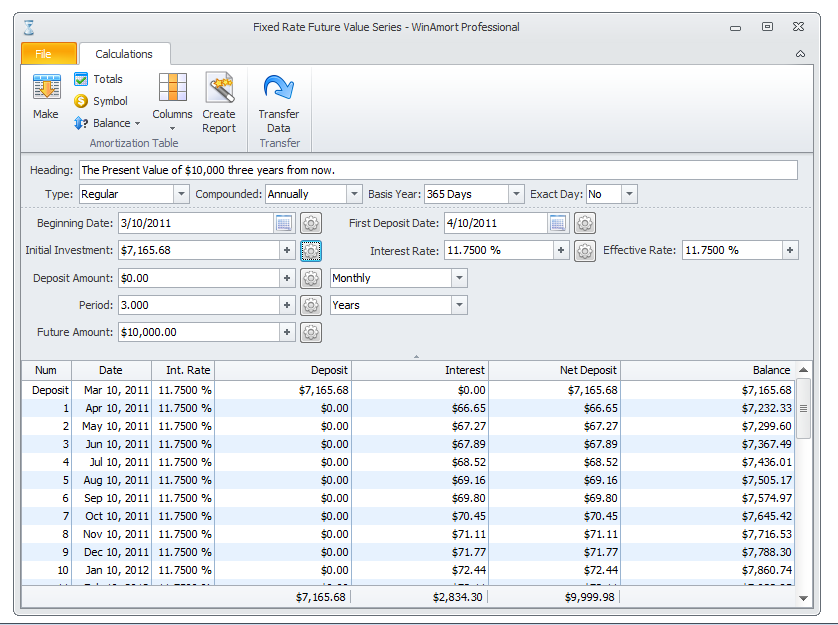

Present Value - EXAMPLE 1a |

What is the Present Value today of a $10,000 amount receivable in three years. The interest or discounting rate is 11.75% compounded Annually. |

Recall the explanation that the Present Value concept is the reverse of the

Future Value concept. Therefore, if we wanted to calculate the present value of a

future amount, we must use the Future Value form in a different way.

Select the Fixed Rate Future Value form again from the Forms List.

Enter in all of the relevant information given to you in the example.

Enter in all of the relevant information given to you in the example.

Note: This example does not require the dates to be filled in, so you can leave the defaults.

Once you fill in the remaining information in the fields.

Press

|

The Present Value amount Today of $10,000 3 years from now discounted at an interest rate of 11.75% is $7,165.68 |

If you were able to obtain the same answer. You used the form correctly. If you, check the

inputed values with the illustrated window below.

This value tells us that if you were to place $7,165.68 in your bank account which is paying 11.75% interest annually you would

accumulate $10,000 in 3 years. In reverse the $7,165.68 is the Present Value of the $10,000 you would receive in 3 years.

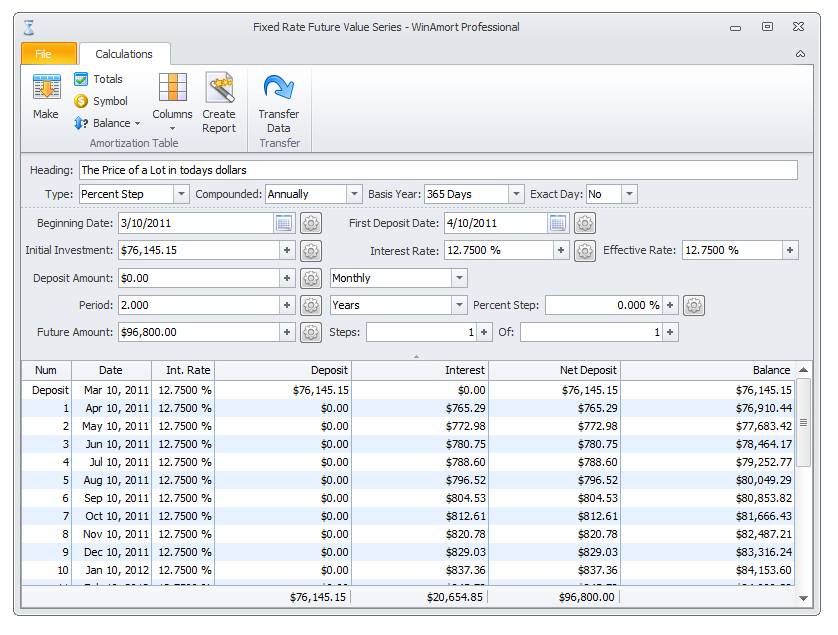

Present Value - EXAMPLE 1b |

A purchaser promises to pay you $96800 two years from now for an acre of land, you currently own. This amount includes interest at an annual rate of 12.75 percent, and the first deposit date will be August 15, 1997. What are you selling the land to him for in today’s dollars? In other words what is the present value of the $96800 you will receive in 2 years? |

![]() Solve The Present Value of $96,800 in two years?

Solve The Present Value of $96,800 in two years?

Once again this question can easily be answered. Fill in all of the appropriate fields

and press the COMPUTE button at the unknown (Initial Investment field).

Check your form with the one illustrated below.

Note: The Date does not affect the calculation in this example as well.

Press

|

The Present Value amount Today of $96,800 2 years from now discounted at an interest rate of 12.75% is $76,145.15 |

The lot which the purchaser is going to pay $96,800 for, in 2 years is only worth $76,145.15 today.

(The Present Value of $96,800 in 2 years is $76,145.15 today.)

From the two examples we have just seen you should be able to understand what we mean by Present Value.

Now let’s put our understanding of the concept to another test. Try the problems on the following page.

Let’s take a look at an example involving real estate.